Jio Financial Services (JFS) is a financial services company that was demerged from Reliance Industries Limited (RIL) in 2022. JFS business model is providing a range of financial services to consumers and businesses in India.

JFS services

Lending service to consumers : Jio Financial Services offers loans to consumers to purchase consumer durable goods such as televisions, refrigerators, mobiles.

Lending service to merchants: Jio Financial Services also offers loans to retail merchants to finance their inventory and working capital required for daily needs.

Business loans to SMEs:Jio Financial Services offers loans to small businesses to finance their business expense and growth needs.

Upcoming finance sector: JFS is planning disrupt Mutual fund, Insurance and Lending as well same again like Telecommunication and OTT Services

These products and services allow consumers and businesses to make payments, transfer money, and access financial services digitally.

Jio Financial Services business uses of their own technology platform and partnerships to deliver financial services to customers in a more efficient way. These way JFS inhancing the digital financial experience.

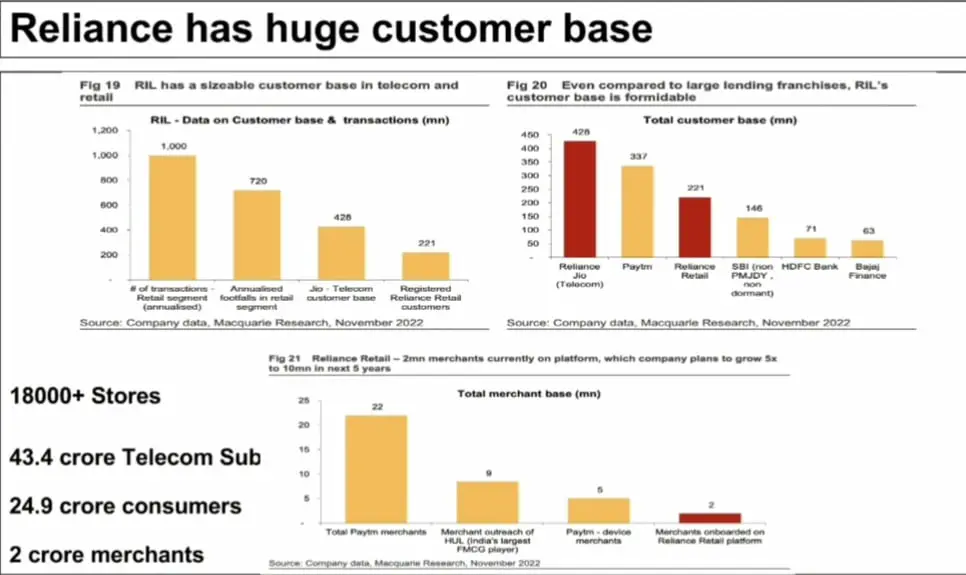

Jio Financial Services is targeting a large number of audience and also growing market of India. The country’s financial services sector is expected to grow at CAGR of 12% over the next 5 years. Jio Financial Services is well-positioned to capitalise on this growth, given its strong parent company, its large customer base, and its focus on technology.

Jio Financial Services is very scalable business and can expand its reach by partnering with own exiting business like reliance retail and online jio customer.

Jio Financial Services is new company, but it has the potential to be a major player in the Indian financial services sector. The company has three big factor Affordability Digital solution and it’s technology will be able to capture the market and succeed.

New sector of jio financial Slservices

Reliance industry is once again on the brink of transformation from revolutionizing same before in telecom industry with Jio, to reshaping the entertainment landscape with Jio Cinema. Now set it’s own height on the financial and mutual fund sector.

Jio Financial Services and how it’s poised to redefine the future of the mutual fund industry. Prepare to witness a potential game-changer that could send shockwaves to companies like Bajaj Finserv Ltd and Bajaj Finance Ltd.

It’s the strategic move by Jio Financial Services and how BlackRock, one of the world’s largest asset management companies, is collaborating with Jio Financial Services to bring affordable and innovative investment solutions to millions of Indian investors.

Mukesh Ambani is keeping his plans under wraps, leaving us guessing about the exact nature of Jio Financial Services offerings. Will it venture into mutual funds, insurance, lending or something entirely unexpected?

People think that reliance demerge telecommunication sector but now take big decision on financial sector. When reliance separate entity jio Financial Services itself valued 1.66 lakh crore.

Company one by one separate entity and make it big. With this decision jio Financial Services came under top 50 company list. It became 8th largest Company in finance sector and 3rd largest in non banking finance sector.

Key companies under Jio Financial Services

| Reliance Industrial Investment and Holding Ltd. (holds RIL Treasury shares) |

| Reliance Payment Solutions Ltd. |

| Jio Information Aggregator Services Ltd. |

| Reliance retail insurance broking Ltd. |

| Jio Payment Banks Ltd. |

Which sector will target jio finance services?

According to sources Reliance try to disrupt the Mutual fund sector, insurance sector and lending sector also.We knew that how jio is capturing online customer and reliance retail capturing offline customer and this is pre-planned strategy helps further in financial sector.

Jio finance services partnered with BlackRock company each Company investef 150 million dollar to expand in asset management business. We all know that BlackRock is biggest asset management company in the world and reliance want to capture available this big opportunity in India.

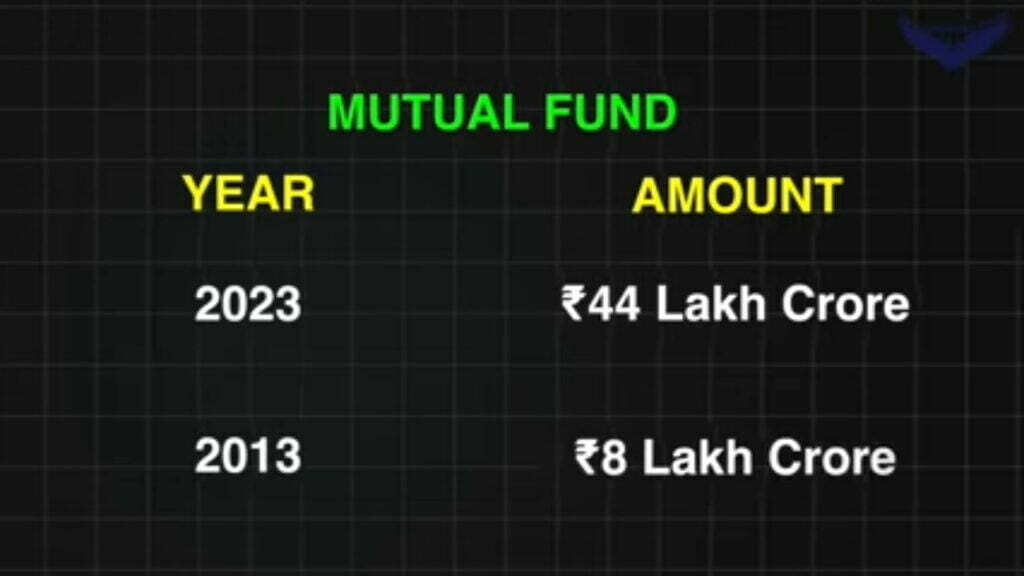

Why entering in mutual fund sector?Now mutual fund industry manage around 44 lakh crore. More important thing that it is grow CAGR with more than 20%.in 2013 it manage 8 lakh crore only.

According to the report of Edelweiss in 2022, only 9.7 % people invest in mutual fund. Invest in the aspect like real estate, lending, insurance etc.

Today 6.65 cr people invest in SIP it’s average value around 1100 cr means monthly average investment ia 2200 rupee.

Today more than 44 company registered in financial sector like PSU, Private bank, NBFC, Digital platform like Paytm, Zerodha etc. Out of 44, top 10 company manage 80% of wealth.